Stock investment in Australia offers a plethora of opportunities for individuals looking to grow their wealth through the financial markets. With a robust and well-regulated stock market, investors have access to a wide range of companies spanning various sectors, making it an attractive destination for both local and international investors.

Overview of the Australian Stock Market:

The Australian Stock Exchange (ASX) is the primary stock exchange in Australia, where most of the country’s top companies are listed. The ASX is renowned for its transparency, liquidity, and investor-friendly regulations, making it a preferred choice for investors looking to invest in Australian equities.

Key Investment Opportunities:

Australia is home to various industries, including mining, financial services, healthcare, technology, and consumer goods, offering investors a diverse set of investment opportunities. Some of the key stocks to consider in the Australian market include Commonwealth Bank of Australia, BHP Group, CSL Limited, and Woolworths Group.

Current Market Trends:

In recent years, the Australian stock market has witnessed significant growth, buoyed by strong economic fundamentals, robust corporate earnings, and a favorable regulatory environment. However, geopolitical uncertainties, trade tensions, and the global economic outlook can impact market sentiment, so investors need to stay vigilant and adapt their strategies accordingly.

Investment Strategies:

When it comes to stock investment in Australia, investors can adopt various strategies based on their risk appetite and investment goals. Some common strategies include value investing, growth investing, dividend investing, and momentum investing. It is essential to have a well-defined investment strategy and stick to it consistently to achieve long-term success in the market.

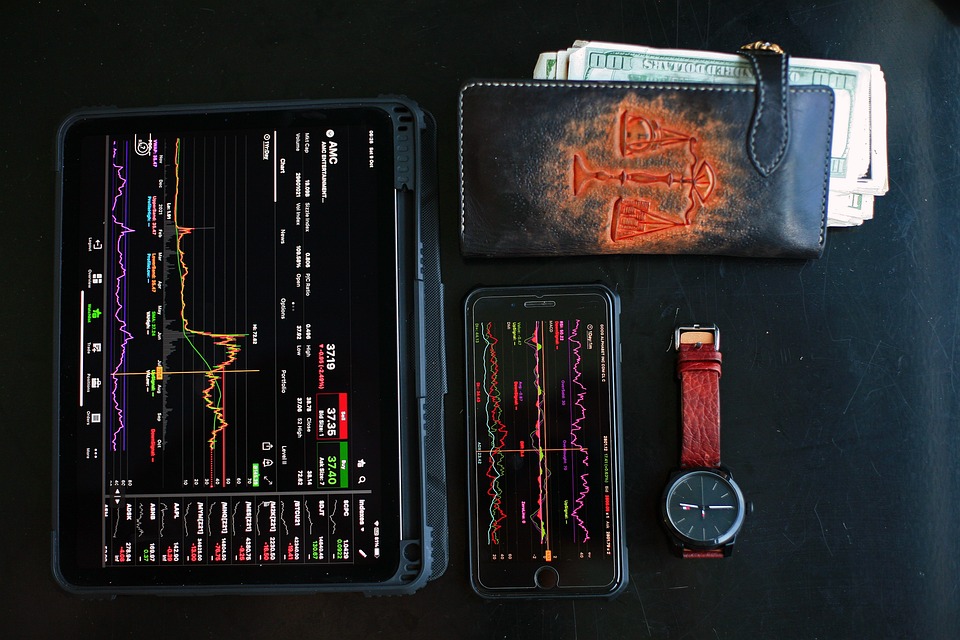

Performance Metrics and Stock Analysis:

Investors can evaluate the performance of stocks using fundamental and technical analysis. Fundamental analysis involves assessing a company’s financial health, earnings potential, and market position, while technical analysis focuses on historical price patterns and market trends to predict future price movements. Key performance metrics to consider include price-to-earnings ratio, return on equity, and earnings per share growth.

Portfolio Management:

Diversification is key to successful stock investing, as it helps reduce risk and optimize returns. Investors should build a well-balanced portfolio comprising stocks from different sectors and asset classes to mitigate volatility and achieve sustainable growth over time. Regular monitoring and rebalancing of the portfolio are essential to ensure it remains aligned with the investor’s financial objectives.

Financial Instruments for Stock Investment in Australia:

In addition to investing directly in individual stocks, investors can also consider other financial instruments such as exchange-traded funds (ETFs), managed funds, and options to gain exposure to the Australian stock market. These instruments offer diversification, flexibility, and ease of access for investors looking to build a well-rounded investment portfolio.

Tips for Successful Stock Investing:

1. Conduct thorough research before investing in any stock.

2. Define your investment goals and risk tolerance.

3. Diversify your portfolio to mitigate risk.

4. Keep emotions in check and stick to your investment strategy.

5. Regularly review and adjust your portfolio based on market conditions.

In conclusion, stock investment in Australia presents a wealth of opportunities for investors seeking to grow their wealth over the long term. By understanding the nuances of the Australian stock market, adopting sound investment strategies, and diversifying their portfolio effectively, investors can navigate the market successfully and achieve their financial goals. With proper due diligence and discipline, stock investing in Australia can be a rewarding endeavor for both seasoned and novice investors alike.