Stock investment in Australia offers a variety of opportunities for investors looking to diversify their portfolios and potentially generate attractive returns. The Australian stock market, also known as the Australian Securities Exchange (ASX), is one of the largest exchanges in the Asia-Pacific region and provides access to a wide range of listed companies across various sectors.

Overview of the Australian Stock Market:

The Australian stock market is home to a diverse array of companies, ranging from large multinational corporations to small and medium-sized enterprises. The ASX is divided into different indices, with the S&P/ASX 200 being the most widely followed benchmark index. This index consists of the top 200 companies listed on the ASX by market capitalization.

Key Investment Opportunities:

Australia is known for its robust resources sector, which includes companies involved in mining, energy, and agriculture. Additionally, the financial services sector is another significant contributor to the Australian economy. Other key industries represented on the ASX include healthcare, technology, and consumer staples.

Current Market Trends:

In recent years, the Australian stock market has experienced volatility due to global economic events and domestic factors such as interest rate fluctuations and regulatory changes. However, the market has shown resilience and continues to attract investors seeking growth opportunities. As of [insert date], the ASX has delivered a [insert performance metric] return year-to-date.

Investment Strategies:

When investing in Australian stocks, it is essential to develop a well-thought-out investment strategy. This may include factors such as risk tolerance, investment horizon, and financial goals. Some common investment strategies employed by investors in Australia include value investing, growth investing, and dividend investing.

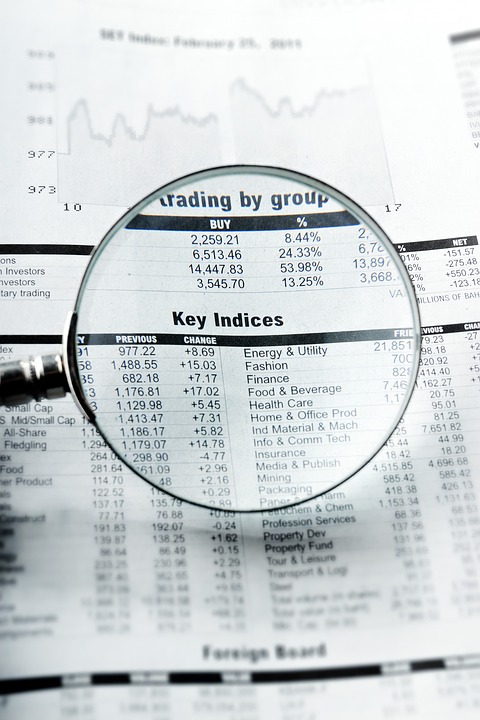

Performance Metrics and Stock Analysis:

Investors can use various performance metrics and stock analysis tools to evaluate the financial health and valuation of companies listed on the ASX. Some popular metrics include price-to-earnings ratio, earnings per share, and return on equity. Stock analysis techniques such as fundamental analysis and technical analysis can help investors make informed decisions.

Portfolio Management:

Diversification is a crucial aspect of portfolio management in stock investing. By spreading investments across different sectors and companies, investors can reduce risk and potentially enhance returns. Regular monitoring of the portfolio and rebalancing when necessary are also important elements of effective portfolio management.

Financial Instruments:

In addition to investing in individual stocks, investors in Australia can access the stock market through various financial instruments such as exchange-traded funds (ETFs), managed funds, and options. These instruments offer different levels of risk and return potential, providing investors with a range of choices to suit their investment objectives.

Tips for Successful Stock Investing:

Successful stock investing requires research, discipline, and patience. Investors should conduct thorough due diligence on companies before making investment decisions, stay informed about market trends, and avoid emotional decision-making. Seeking professional advice from financial advisors or investment experts can also be beneficial for novice investors.

In conclusion, stock investment in Australia offers a wealth of opportunities for investors seeking to grow their wealth over the long term. By understanding the dynamics of the Australian stock market, employing sound investment strategies, and staying informed about market trends, investors can make informed decisions and potentially achieve their financial goals.